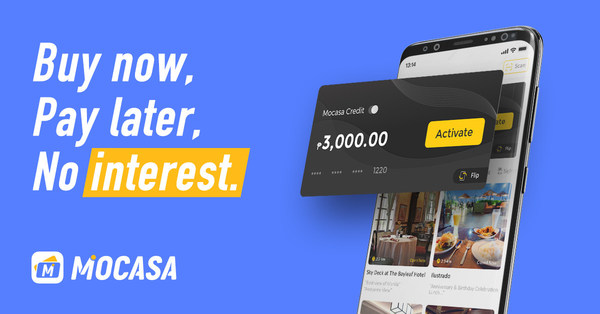

MANILA, Philippines, Jan. 21, 2022 /PRNewswire/ — Mocasa (“the Company”), an international fintech platform providing personalized financial services, officially launched its signature Buy Now Pay Later (BNPL) services in the Philippines in December 2021, providing consumers with a mobile payment option to pay with credit upfront and repay the bill at a future date.

Mocasa is an app which can be easily downloaded from Google Play for Android phones. It works with thousands of online and offline merchants such as stores, dining franchises, and cinemas. Users can browse favorable stores listed on the Mocasa app and pay with a financially-friendly credit payment option — BNPL — through QR code. No interest is charged in the billing cycle. Nor is cash transaction or bank quality needed. On the Mocasa app, users can simply shop online, top up their phones, or pay for the food in-store — all in one place.

To activate Mocasa credit, users need to go through an easy Know-Your-Customer (KYC) process and get approved in as fast as one second. Unlike most credit providers, Mocasa ensures most users will be granted a credit line to start building their credit profile.

“Mocasa aims to disrupt the credit card industry by enabling credit services to the majority of Filipinos,” said Julien Chien, Mocasa COO. “We observed the majority who deserve better financial services are being kept outside traditional financial institutions. Mocasa makes sure most users in the Philippines receive a credit line and helps them build a life-time credit profile with a good repayment history.”

Rather than luring users to take on more debt, Mocasa appropriately adjusts the credit line based on analysis of user daily purchases and repayment behavior, to help users manage a healthy budget and form good repayment habits.

While Mocasa BNPL helps relieve consumers’ financial pressure, it also benefits merchants. It serves as a great venue for businesses to expand sales. The company is experienced at acquiring millions of daily active users. The AI algorithm refers a great number of high quality customers to proper merchants.

Mocasa aims to build an integrated platform that connects consumers and merchants. By providing “buy now pay later” services, it wishes to better serve the public and becomes a true mobile home as its name stands for.

To learn more about Mocasa BNPL or download the app, please visit: https://www.mocasa.com/

Donate To The Indian Sun

Dear Reader,The Indian Sun is an independent organisation committed to community journalism. We have, through the years, been able to reach a wide audience especially with the growth of social media, where we also have a strong presence. With platforms such as YouTube videos, we have been able to engage in different forms of storytelling. However, the past few years, like many media organisations around the world, it has not been an easy path. We have a greater challenge. We believe community journalism is very important for a multicultural country like Australia. We’re not able to do everything, but we aim for some of the most interesting stories and journalism of quality. We call upon readers like you to support us and make any contribution. Do make a DONATION NOW so we can continue with the volume and quality journalism that we are able to practice.

Thank you for your support.

Best wishes,

Team The Indian Sun