– Presenting a suitable daily life e-finance platform amid the COVID-19 crisis.

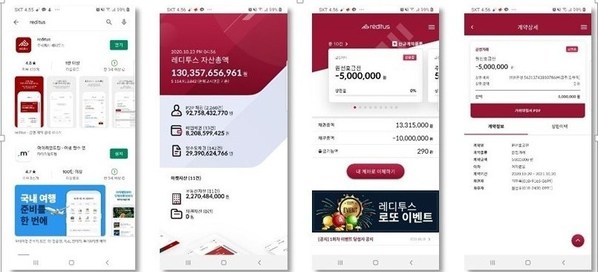

SEOUL, South Korea, Oct. 28, 2020 /PRNewswire/ — The Korean e-finance transaction platform, Reditus (CEO, Gilmo Jang) has launched a mobile App for open banking to contact anywhere, anytime.

Regarding the continuous spread of COVID-19, change has come to financial platforms. Reditus has developed a Receivables Management System (RMS), which provides 400 different types of everyday life contracts, including an e-finance promissory note, employment contract and rental contract. Reditus also supports banking services and contract protection services considering the new global trend due to the coronavirus such as an untact consumption and a non-face-to-face financial transaction paradigm. With the extended customer base related to COVID-19, electronic contract cases on the Reditus platform based on the e-finance promissory note exceeded 1,500 cases.

Daily life financial integration platforms provided by Reditus are divided into different sections such as E-Contract, Banking and Contract Protection. The e-contract is a smart contract type without paper documents, which is appreciated as a non-face-to-face solution.

Reditus offers an e-finance promissory note as well as 400 different types of contracts including a credit transaction contract and employment contract. All formats can be customized following the user’s requests.

The banking service is a non-face-to-face service mainly for managing contract fulfillment such as remittance, transfer and notice. When a contract is authorized, a virtual receivable account will be created, and the contractors can freely remit and transfer to each other through the account. When the contractors acknowledge their money transactions through the banking service, not only the e-finance promissory note will be issued, but also bond management solutions will be provided without any charge such as a fixed date for the legal acknowledgment of the commencement of the transaction and free receivable collection service.

An CEO, Gilmo Jang said, “Reditus is based on the specialized RMS and offers low commission fee and collection expense with advanced security for safe daily e-finance. Our customer base is expected to grow as COVID-19 continues.”

Those who want to write an e-finance promissory note on the Reditus app can download the app on Google Play and App Store and start to use it after a simple verification process.

Donate To The Indian Sun

Dear Reader,The Indian Sun is an independent organisation committed to community journalism. We have, through the years, been able to reach a wide audience especially with the growth of social media, where we also have a strong presence. With platforms such as YouTube videos, we have been able to engage in different forms of storytelling. However, the past few years, like many media organisations around the world, it has not been an easy path. We have a greater challenge. We believe community journalism is very important for a multicultural country like Australia. We’re not able to do everything, but we aim for some of the most interesting stories and journalism of quality. We call upon readers like you to support us and make any contribution. Do make a DONATION NOW so we can continue with the volume and quality journalism that we are able to practice.

Thank you for your support.

Best wishes,

Team The Indian Sun